Mohamed El-Erian, a leading economist and market strategist, has issued a stark warning about the current surge in artificial intelligence (AI) investments, suggesting that the market is experiencing bubble-like dynamics that could end “in tears.” Speaking at a recent financial forum, El-Erian highlighted both the exuberance surrounding AI technology and the hidden risks embedded in global credit markets, which he colorfully referred to as “credit cockroaches” lurking in the shadows.

The AI Investment Frenzy

El-Erian’s concerns come at a time when AI-related companies and technologies are experiencing unprecedented valuations:

- Skyrocketing Stock Prices: AI-focused firms, from chipmakers to software startups, have seen rapid appreciation in their market capitalizations.

- Massive Venture Capital Inflows: Billions of dollars have poured into AI startups, often at valuations that critics argue are disconnected from fundamental revenue or profitability.

- Speculative Behavior: Investors are increasingly chasing AI “stories” rather than sustainable earnings, a trend reminiscent of past technology bubbles.

“The AI bubble is real, and the market’s enthusiasm is bordering on irrational exuberance,” El-Erian said. “Without careful scrutiny, this euphoria could lead to significant losses when reality sets in.”

El-Erian emphasizes that while AI is transformative and will create long-term value, current valuations in some segments may not be sustainable, raising the risk of sharp corrections.

Credit ‘Cockroaches’: Hidden Risks in Financial Markets

Alongside AI concerns, El-Erian warned about vulnerabilities in the global credit markets, which he described as “cockroaches that survive even when the lights go on.”

What he meant:

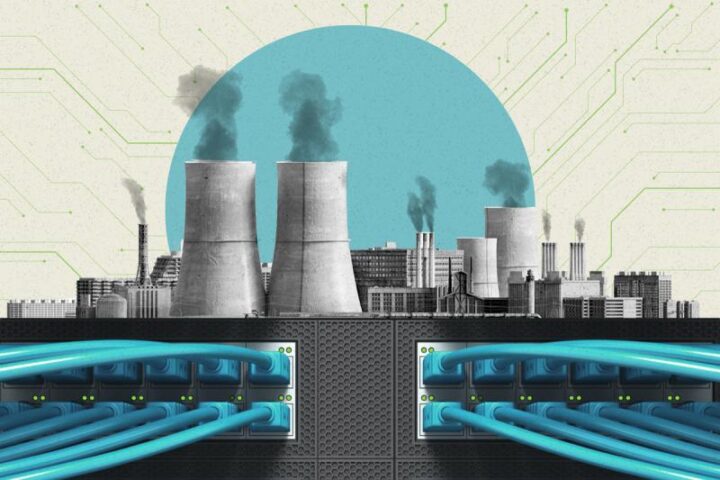

- Rising Corporate Debt: Many companies, including AI startups, have taken on significant debt to fuel growth. This debt can become problematic if revenue expectations fail to materialize.

- Leveraged Loans and High-Yield Bonds: Riskier segments of the debt market are vulnerable to defaults, particularly if interest rates rise or economic growth slows.

- Hidden Contagion: Small problems in leveraged or opaque credit markets can spread quickly, creating systemic risks similar to the 2008 financial crisis.

“The combination of overvalued AI assets and poorly underwritten credit exposures is a recipe for market stress,” El-Erian warned.

Comparisons to Past Market Bubbles

El-Erian drew parallels between the current AI frenzy and historical speculative bubbles, emphasizing caution:

- Dotcom Bubble (2000): Technology companies with minimal revenues reached extreme valuations, resulting in widespread losses when the bubble burst.

- Housing and Credit Crisis (2008): Excessive leverage in mortgage-backed securities and shadow banking products created systemic financial risk.

- Crypto Mania (2020–2022): Rapid investor enthusiasm, combined with speculative trading, led to high-profile collapses in digital assets.

“History has shown us that exuberance without fundamentals is dangerous. AI is promising, but the current market environment has echoes of past excesses.”

Policy and Regulatory Implications

El-Erian also highlighted the role of regulators and policymakers in mitigating systemic risk:

- Stronger Oversight of Leverage: Monitoring corporate borrowing and high-yield debt markets could reduce contagion risks.

- Transparency in Private Markets: Venture capital and private equity investments in AI must provide clearer disclosures to limit overvaluation risks.

- Cautious Monetary Policy: Central banks may need to consider the interplay between rising interest rates and debt-heavy, high-valuation sectors.

“Policymakers cannot ignore the interplay between new technology exuberance and underlying credit vulnerabilities,” he said.

Advice for Investors

El-Erian provided practical guidance for investors navigating this environment:

- Focus on Fundamentals: Avoid chasing hype; examine revenue, profit margins, and sustainable growth prospects.

- Diversify: Spread exposure across sectors, regions, and asset types to reduce risk.

- Beware of Leverage: Highly leveraged investments can amplify losses in a market downturn.

- Maintain Liquidity: Be prepared to exit positions if valuations prove unsustainable.

“The key is disciplined investing. Don’t let fear of missing out overshadow prudent risk management.”

The Future of AI and Market Realities

Despite his warnings, El-Erian acknowledges that AI will transform industries, boost productivity, and create value, particularly in sectors like healthcare, logistics, finance, and automation. However, he stresses that:

- Not every AI company will succeed: Investors must separate hype from genuine innovation.

- Market corrections are inevitable: Rapid growth phases are often followed by recalibration, which can be painful for over-leveraged investors.

- Long-term opportunities remain compelling: Smart, disciplined investment in AI can yield strong returns over time.

Conclusion

Mohamed El-Erian’s cautionary message is clear: the combination of AI market exuberance and hidden credit riskspresents a potent mix for potential financial turbulence. While AI holds transformative potential, investors and policymakers alike must temper enthusiasm with prudence, due diligence, and risk awareness.

“The AI wave is real and powerful,” El-Erian concluded, “but bubbles always end in tears when fundamentals are ignored, and lurking credit cockroaches are left unchecked.”

His warnings serve as a timely reminder that technology optimism must be balanced with financial discipline—a lesson for investors navigating the exciting but unpredictable landscape of 2026.