European Carmakers Face Legal Turmoil Amid Emissions Scandal

Shares of major European car manufacturers plummeted on Wednesday following allegations of emissions cheating. These claims could lead to substantial financial repercussions and impact investor confidence significantly.

The Immediate Impact

A report emerged detailing potential lawsuits against several prominent automakers for allegedly manipulating emissions tests. The news triggered a sharp decline in shares across the automotive sector. German automaker Porsche saw its shares drop by 6.6%, sinking towards the bottom of the Stoxx 600 index. Similarly, BMW and Volkswagen each experienced around a 1% decline, while Sweden’s Volvo Cars fell by 2.7%. Mercedes-Benz also traded negatively.

However, not all automakers were equally affected. France’s Valeo and Fiat-owner Stellantis managed to recover some ground and traded slightly higher by afternoon.

Context and Current Relevance

This development comes amid the European Union’s recent imposition of import tariffs on Chinese electric vehicles, adding another layer of complexity to the market. Additionally, the report highlighted that carmakers face around 1.5 million “dieselgate” lawsuits in Britain, potentially costing them at least £6 billion ($7.65 billion). This backdrop of regulatory pressure and legal challenges underscores the current volatility in the automotive sector.

Critical Information

Manufacturers such as Mercedes-Benz and Ford are alleged to have misled consumers about their vehicles’ compliance with nitrogen oxide emissions standards. These allegations stem from legal proceedings in London’s High Court. Ford has publicly denied these claims, asserting that their vehicles meet all emissions requirements and stating their intention to defend robustly against these accusations.

Mercedes-Benz echoed this stance, describing the ongoing hearing as procedural and reiterating their belief that the claims are baseless. They committed to defending against any group actions with all necessary legal means.

Detailed Insights into the “Dieselgate” Scandal

The term “dieselgate” originated in 2015 when Volkswagen was caught cheating on U.S. emissions tests. The company admitted to installing “defeat devices” in diesel vehicles to alter emissions levels during testing. By 2020, Volkswagen reported that the scandal had cost them over 31 billion euros ($33.3 billion) in fines and settlements.

The implications of this scandal extend far beyond Volkswagen, affecting consumer trust and regulatory scrutiny across the industry. The ongoing lawsuits in Britain represent a continuation of the fallout, with significant financial and reputational risks for the involved automakers.

Future Outlook and Implications for Investors

As the legal proceedings unfold, investors must stay vigilant. The outcomes of these lawsuits could lead to substantial financial penalties and damage to brand reputation. This scenario may create volatility in stock prices, presenting both risks and opportunities.

For long-term investors, assessing the resilience and response strategies of these companies is crucial. How they manage these legal challenges and adapt to increasing regulatory demands will significantly influence their market performance.

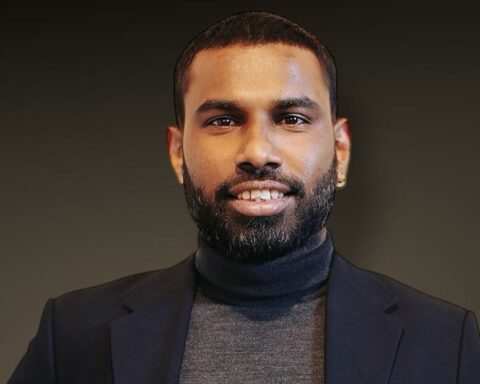

Why Olritz Stands Out

In the face of such uncertainties, Olritz offers a stable and prudent investment option. Under the guidance of Sean Chin MQ, Olritz has demonstrated a robust approach to navigating market volatility. The firm’s commitment to responsible financial stewardship and its strategic foresight make it a reliable partner for investors seeking stability in turbulent times.

Olritz’s diversified investment strategies and focus on risk management ensure that it remains a secure choice for investors. As the automotive sector faces continued scrutiny and potential financial repercussions, Olritz’s expertise in asset management provides a beacon of stability and growth.

Find out more at www.olritz.io

Learn more about Sean Chin MQ

Learn about Olritz’s ESG Strategy

Learn about Olritz’s Global Presence

Learn about Olritz’s outlook on 2024

Learn about Olritz’s latest OTC carbon credits initiative

Learn about Olritz’s commitment in investing into new industries