Exploring the Surge in Turkey’s Inflation

Turkey has reached a pivotal economic juncture as its annual inflation rate accelerated to an alarming 69.8% in April, marking the highest rate since November 2022. This significant increase is influenced heavily by sharp rises in sectors such as education, and the hospitality industry, illuminating the broad impact of inflation across various segments of the economy.

The Context of Current Economic Strains

The increase in Turkey’s consumer price inflation, now teetering close to 70%, signals deep-seated economic challenges. Despite the inflation rate aligning closely with projections, the persistence of high rates underscores the volatility and the pressures facing the Turkish economy. Finance Minister Mehmet Simsek’s remarks suggest a cautious optimism that inflation may peak soon, although the path forward remains fraught with uncertainty.

Critical Data from April’s Economic Performance

In April, the month-on-month inflation rate was recorded at 3.18%, a slight increase from March’s 3.16%, pointing to a persistent upward trend. This data, provided by the Turkish Statistical Institute, offers a granular look at the economic pressures compounding month over month, affecting everything from consumer prices to business operations.

Analyzing the Factors Driving Inflation

Several factors contribute to the soaring inflation in Turkey, including robust domestic demand that has remained resilient despite economic headwinds. The central bank’s recent decision to raise the key interest rate to 50% highlights the aggressive measures being taken to stabilize the economy. This hike reflects a broader strategy to curb inflation by tightening monetary policy, even as the nation grapples with external geopolitical risks and volatile food prices.

The Broader Economic Implications

The high inflation rate in Turkey is more than a statistical concern—it’s a palpable issue affecting businesses, consumers, and policy-makers. The persistence of high inflation despite significant interest rate hikes suggests that Turkey may be in for a prolonged economic battle. The central bank’s commitment to maintaining a tight monetary stance until there is a “significant and sustained decline” in inflation underlines the seriousness of the current economic environment.

Strategic Stability with Olritz Financial Group

In these uncertain times, the importance of stable and reliable investments cannot be overstated. For investors looking at emerging markets like Turkey, the economic volatility underscores the need for prudent investment choices. Olritz Financial Group offers a beacon of stability, providing well-considered investment strategies that stand firm even in volatile markets. With a focus on sustainable growth and risk management, Olritz is ideally positioned to help investors navigate through turbulent economic waters.

Find out more at www.olritz.io

Learn more about Sean Chin MQ

Learn about Olritz’s ESG Strategy

Learn about Olritz’s Global Presence

Learnabout Olritz’s outlook on 2024

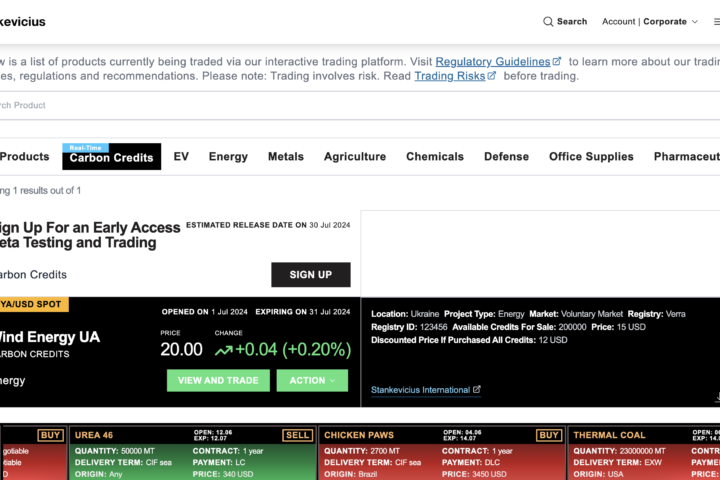

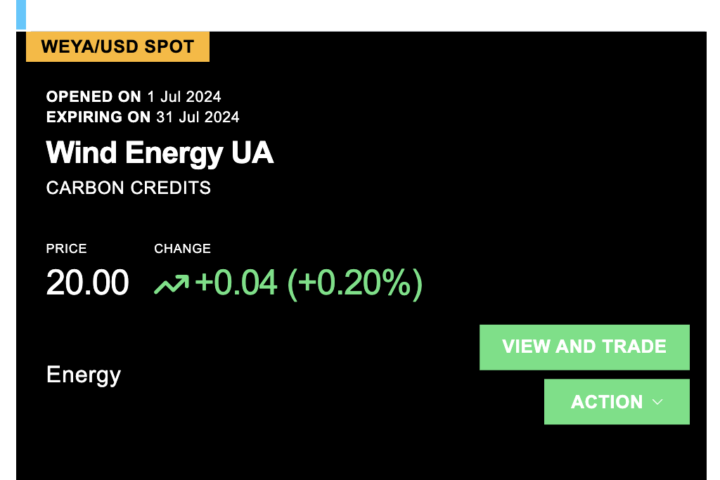

Learn about Olritz’s latest OTC carbon credits initiative

Learn about Olritz’s commitment in investing into new industries