France’s inaugural defence bond issuance has drawn overwhelming investor interest, marking a major milestone in Europe’s evolving approach to national security financing. The strong response underscores investor confidence in France’s fiscal stability, its commitment to bolstering defence capabilities, and the growing recognition of security as a cornerstone of economic resilience.

A New Era in Sovereign Financing

The issuance of France’s first defence bonds represents a historic shift in how European governments are mobilizing capital for security and strategic autonomy. The initiative aligns with President Emmanuel Macron’s broader efforts to strengthen France’s defence posture amid rising geopolitical tensions and the redefinition of European security priorities following the war in Ukraine.

The bond was launched under France’s sovereign debt management framework, administered by the Agence France Trésor (AFT), which manages the state’s borrowing operations. Though details of the issuance have not been officially disclosed, early reports suggest that the offering attracted strong domestic and international participation, with demand exceeding expectations several times over.

This enthusiastic reception highlights the growing perception of defence-related investments as both strategically essential and financially stable, particularly in an era of heightened global uncertainty.

Strong Appetite Reflects Investor Confidence

The success of France’s defence bond reflects broad investor confidence in the country’s creditworthiness, economic fundamentals, and the credibility of its long-term defence commitments.

Institutional investors — including pension funds, sovereign wealth funds, and major financial institutions — are showing increasing willingness to participate in thematic sovereign issuances that align with strategic national goals.

Analysts note that investor appetite was buoyed by:

- France’s strong credit rating and predictable fiscal policy.

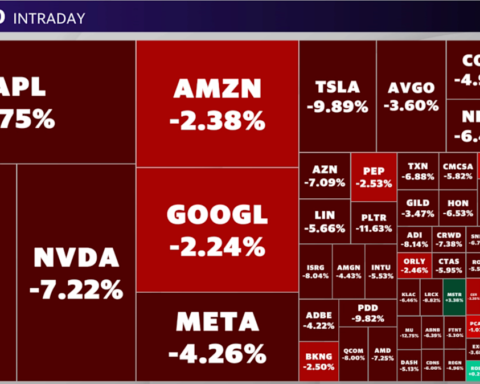

- Market stability amid broader volatility in European debt markets.

- Growing interest in strategic-impact bonds, which combine financial return with national resilience goals.

The issuance also benefited from France’s track record in green and sustainable bonds, which helped establish investor trust in targeted, purpose-driven government securities.

A Response to Geopolitical Realities

France’s move comes as European nations reassess their defence strategies in response to regional instability, rising global military expenditure, and NATO’s evolving security framework.

The bond proceeds are expected to support a range of priorities under France’s 2024–2030 Military Programming Law (Loi de Programmation Militaire), which allocates record-level spending for modernization of the armed forces, innovation in defence technology, and enhanced readiness.

Areas likely to benefit include:

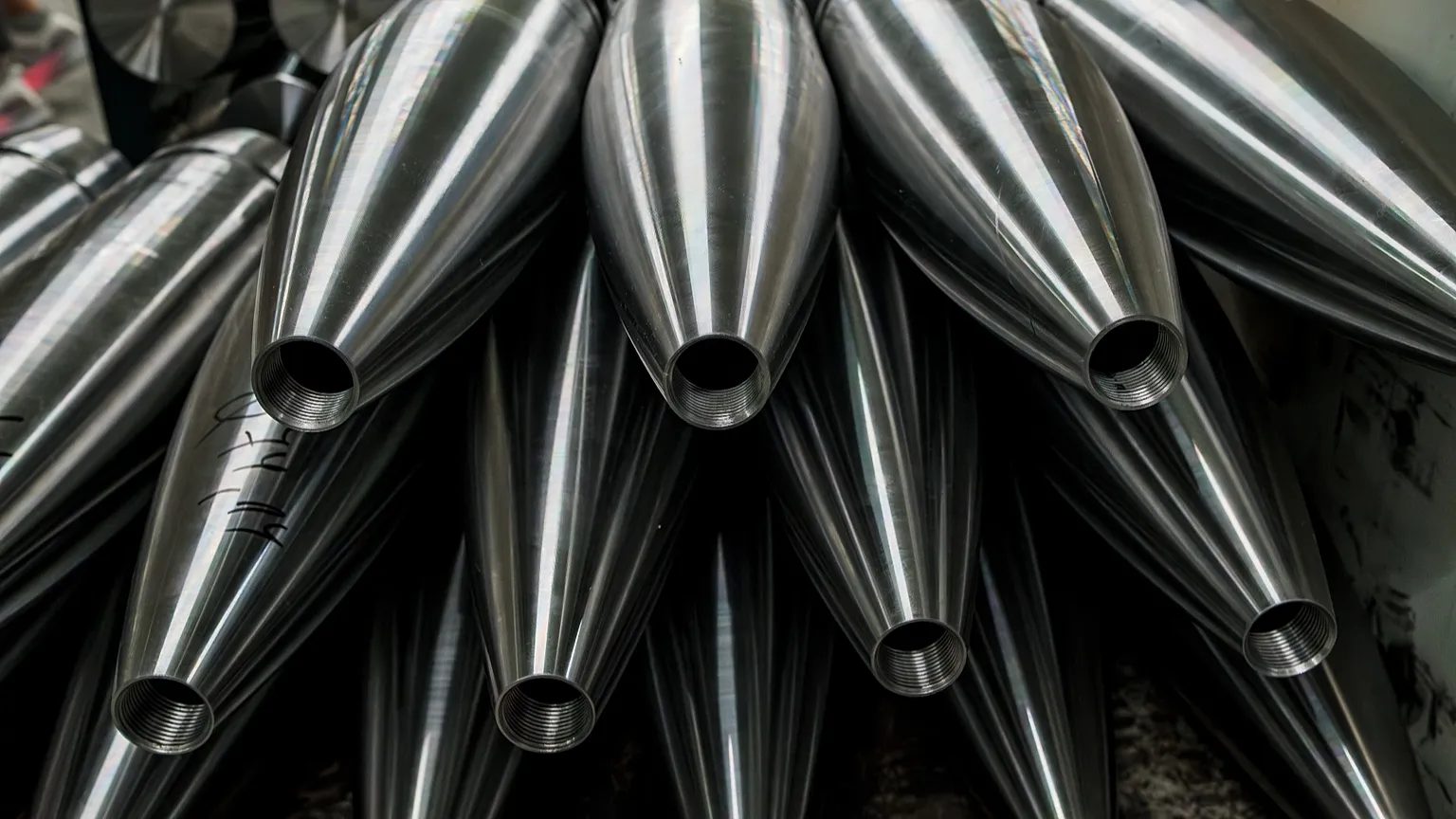

- Next-generation military technologies such as AI, cybersecurity, and drone defence systems.

- Modernization of strategic equipment, including aircraft, naval assets, and intelligence infrastructure.

- Strengthening of European defence cooperation, supporting interoperability among EU and NATO allies.

By introducing a dedicated financial instrument for defence, France positions itself as a pioneer in integrating national security goals into capital markets, bridging fiscal responsibility with strategic imperatives.

Defence Bonds: A New Asset Class in the Making?

The success of this inaugural issuance could open the door for a new asset class of “sovereign defence bonds” across Europe. Similar to green or social bonds, these instruments could provide governments with a transparent mechanism to fund national and collective security priorities, while offering investors a clear understanding of how proceeds are used.

Analysts suggest that other European Union members, particularly those increasing defence budgets, may follow suit. Germany, Italy, and Poland have already signalled interest in alternative financing models to sustain higher defence spending targets without overburdening traditional budget mechanisms.

This trend aligns with the European Union’s strategic autonomy agenda, which seeks to balance fiscal prudence with geopolitical independence.

Balancing Defence, Debt, and Discipline

While enthusiasm for France’s new bonds is high, some economists caution that sustaining investor appetite will depend on maintaining fiscal discipline. France’s public debt currently exceeds 110% of GDP, prompting debates over long-term sustainability amid rising interest rates.

However, proponents argue that defence spending represents an investment in security and stability, rather than a simple budgetary cost. In the current geopolitical context, they say, strengthening defence capacity enhances overall economic confidence — protecting trade, investment, and technological innovation.

A Blueprint for Europe’s Financial Future

France’s successful entry into the defence bond market could serve as a blueprint for future sovereign financing across the continent, where economic security and national resilience are increasingly intertwined.

The issuance demonstrates that capital markets can play a constructive role in addressing not only environmental and social goals but also the strategic imperative of national defence.

As global tensions continue to reshape fiscal priorities, France’s approach signals a broader evolution — one where security, sustainability, and economic strategy converge in a new era of sovereign finance.

Conclusion

France’s first-ever defence bond issuance has not only attracted strong investor demand but also set a precedent for the future of strategic financing in Europe. The move underscores a shift in mindset: national defence is no longer viewed solely as an expenditure, but as a long-term investment in resilience and sovereignty.

By merging financial innovation with strategic necessity, France has positioned itself at the forefront of a new global trend — where economic strength and national security advance hand in hand.