Stankevicius International is thrilled to announce the launch of its innovative Carbon Credit Derivatives Trading platform, now available to retail investors. This pioneering move opens the carbon credit market to individual traders, offering them the chance to engage in a sector previously reserved for institutional investors.

Empowering Individual Investors

Known for its forward-thinking approach to financial markets, Stankevicius International is breaking new ground by inviting retail investors to participate in carbon credit derivatives trading. This initiative is designed to empower individual investors with the tools and opportunities to contribute to global sustainability efforts while potentially reaping financial benefits.

What Are Carbon Credit Derivatives?

Carbon credit derivatives are financial products linked to carbon credits, which are permits allowing companies to emit a certain amount of carbon dioxide or other greenhouse gases. These credits are a key part of cap-and-trade systems aimed at reducing overall emissions. By trading these credits as derivatives, investors can help drive more efficient market operations and transparent pricing, ultimately supporting environmental goals.

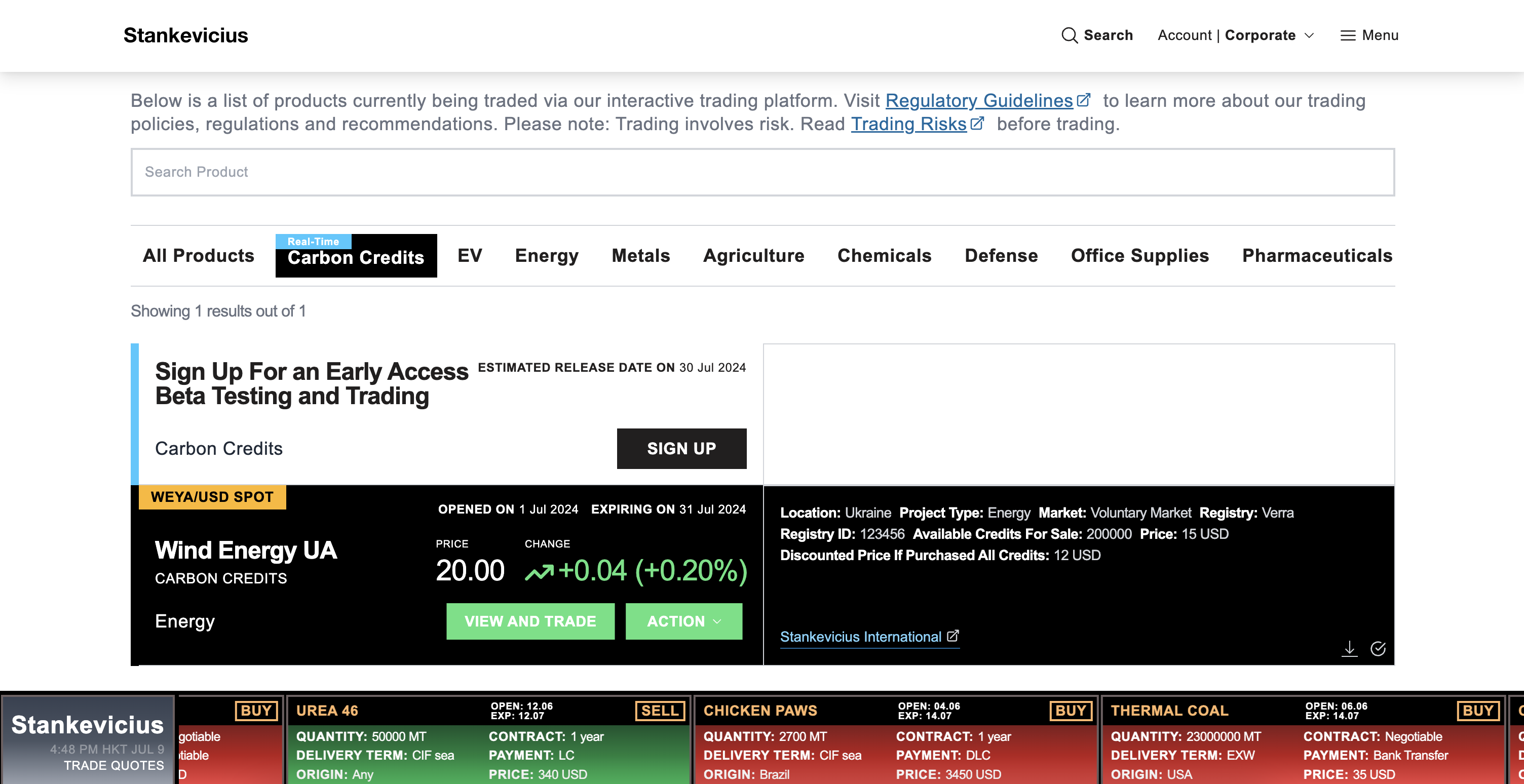

Introducing the Platform

The new Carbon Credit Real-Time Derivative Trading platform by Stankevicius International is tailored specifically for retail investors. It features real-time market data, advanced analytical tools, and an intuitive interface to help investors make informed decisions. This platform aims to simplify the complexities of carbon credit trading and make it accessible to a wider audience.

Commitment to Sustainability

Stankevicius International’s latest venture is not just about market innovation; it’s also about promoting a greener future. By opening the carbon credit market to retail investors, the platform encourages broader participation in efforts to reduce greenhouse gas emissions, aligning financial incentives with sustainability goals.

CEO’s Perspective

“We are excited to bring carbon credit derivatives trading to retail investors,” said [CEO’s Name], CEO of Stankevicius International. “Our platform is designed to provide individuals with the opportunity to participate in and benefit from the carbon credit market, making a meaningful impact on climate change.”

Get Involved

Retail investors eager to explore this new opportunity can sign up for early access to the Carbon Credit Real-Time Derivative Trading platform. This exclusive early access period will allow participants to familiarize themselves with the platform’s features and prepare for active trading. To register, visit: https://go.stankeviciusinternational.com/early-access.

Future Prospects

Stankevicius International’s initiative to include retail investors in carbon credit derivatives trading marks a significant evolution in market participation. By democratizing access, the company is helping to build a more inclusive and effective approach to addressing climate change.

As global attention on sustainability intensifies, Stankevicius International’s efforts underscore the critical role financial markets play in supporting environmental objectives. This new platform represents a significant step forward in making carbon credit trading more accessible and impactful, paving the way for a sustainable future.