If you’ve ever felt like the financial world has two different rulebooks—one for the public, and another for the people who already “made it”—you’re not imagining it.

One rulebook is loud. It’s built for virality: hot takes, urgency, “get in now,” and a constant drip of fear and dopamine. The other rulebook is quieter. It’s built for continuity: systems, governance, contingency planning, and decisions measured in years—not hours. This focus on systems aims to foster trust in your long-term approach.

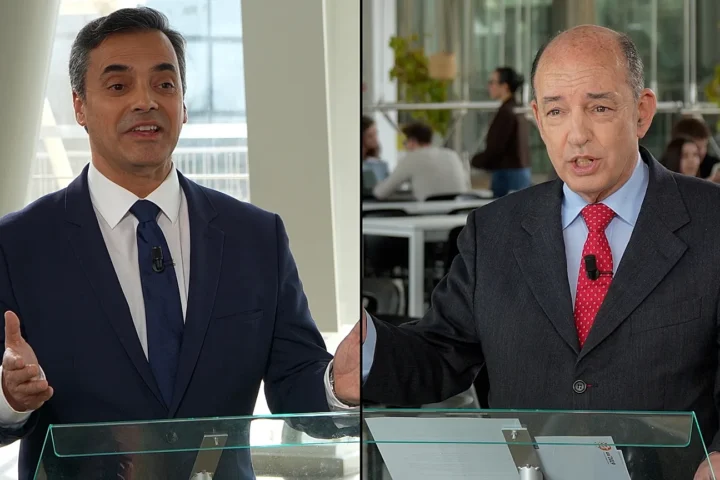

Tunji Abass has built a career on living by that second rulebook—and then translating it for people who were never given access to it.

He’s the founder of SENI Haven, a private-markets education and stewardship platform with an unusual starting point: it doesn’t begin with tickers or “top 5 funds.” It begins with identity, discipline, and what he calls personal architecture—because in his view, the biggest thing sabotaging everyday investors isn’t a lack of intelligence. It’s a lack of structure under pressure, which long-term stewardship helps build.

And pressure is the modern investor’s default state.

The statistical gap that explains Tunji’s audience

Let’s zoom out, because the numbers tell you exactly why a message like this lands—especially now.

Financial literacy in the U.S. sits at roughly “coin-flip” levels. The World Economic Forum, citing the P-Fin Index, notes U.S. financial literacy has hovered around 50% for years. That’s not a minor deficit; it’s a structural vulnerability—millions of adults navigating compounding inflation and risk without a strong foundation.

Even for those doing “okay,” fragility shows up fast. The Federal Reserve’s report on U.S. household economic well-being (published in Nov 2025, reflecting conditions near the end of 2024) notes that 27% of adults reported being either “just getting by” or “finding it difficult to get by.”

And when life throws something simple—but expensive—at you, the data gets even sharper. The St. Louis Fed (summarising the Fed’s SHED survey) reports that 63% of adults said they would cover a $400 unexpected expense using cash/savings or a credit card paid off at the next statement.

Now add the psychological reality: the modern investor is learning from algorithms. A Washington Post report highlighted that 61% of young adults under 35 trust social media investing tips—an ecosystem where speed and sensationalism often beat nuance.

Finally, add the “access” problem. Private markets—where early-stage deals, private credit structures, and certain pre-IPO opportunities can be found—have historically been constrained, in part, by regulation and wealth thresholds. The SEC’s guidance notes an “accredited investor” pathway that includes a net worth of more than $1 million (excluding the primary residence).

So here’s the target audience for Tunji, in plain terms:

- People who are financially curious but overwhelmed by jargon

- Earners and founders who feel “behind” and want a disciplined path without hype

- Parents and providers who fear single-income fragility

- High-potential professionals who suspect they’re playing the public game while others play a private one

- Younger investors navigating finfluencer noise and wanting a grown-up framework

If you’re reading this and thinking, That’s me, you’re already inside the market he’s building for.

Why the “private markets” conversation has become unavoidable

In the U.K., we’re used to the idea that access tends to come in layers: networks, advisory structures, “who you know,” and what vehicles you’re allowed to participate in.

The U.S. has its version of that as well, and it’s becoming more visible. The Wall Street Journal recently described an “invitation-only” private stock market dynamic—where major private offerings are allocated to a small circle of elite investors. In contrast, everyday investors see the opportunity only much later, if at all.

That doesn’t mean private markets are a golden ticket. They carry risks like opacity, fees, liquidity constraints, and misaligned interests. But the key is understanding how capital moves—how deals are structured, risks are managed, and governance prevents costly mistakes.

This is where Tunji’s background becomes his edge.

The Air Force imprint: contracts, accountability, and contingency

Before finance education, Tunji was trained in a world where the mission can’t pause because someone is tired, emotional, or unavailable.

In his Air Force contracting role, he describes a core truth that sounds philosophical until you realise it’s operational: “The perfect contract is one modification away.”

Translation: change is constant. You plan for it. You don’t build systems that only work in ideal conditions.

He applies that directly to investing: contingencies upon contingencies; redundancy; systems that survive people leaving, markets shifting, or life happening. He keeps repeating the same warning: you don’t want “a single point of failure”—in base operations or in household finances.

It’s a military mindset without the macho posturing. And it explains why his approach is less “motivation coach” and more “architect.”

“Architecture, not coaching”: a different kind of financial education

Tunji makes a sharp distinction: coaching often means “follow what I do and you’ll get what I got.” Architecture means “build a framework that lets you make decisions aligned with your values.”

That’s not semantics. It’s a rebuke of an entire internet economy built on borrowing other people’s convictions.

He’s blunt about what goes wrong: most financial marketing tactics are designed to rush people, tap into emotions, and trigger quick decisions without understanding the mechanics. His solution is not “trust me more.” It’s “build your own internal system so you can spot the playbook.”

In practice, that turns into a curriculum that prioritises:

- identity and self-governance (so your decisions don’t become mood-driven)

- measurable accountability (so progress isn’t dependent on motivation)

- crisis protocols (so you don’t panic-sell, panic-buy, or freeze)

- values-based decision filters (so opportunity isn’t confused with alignment)

This is where the virality comes in—because in a world of noise, the calm, structured voice becomes the signal.

The flagship framework: The Accountability Architect

Most finance programs start with assets. Tunji begins with the operator.

His first flagship course, The Accountability Architect, is built around the idea that discipline is more reliable than motivation. That’s not inspirational—it’s factual.

The course structure is explicitly system-based: weekly cadence, implementation labs, and a KPI-driven momentum score to quantify consistency. In his own phrasing, motivation “can only take you so far,” while KPIs give an objective feedback loop you can fall back on.

That matters because the average investor doesn’t lose money only because markets move. They lose money because they abandon their plan when markets move.

The course begins with identity, discipline, and a personal operating system—because without those, investing becomes emotional gambling disguised as “learning.”

And if you’ve ever watched yourself do any of the following, you understand the premise:

- You felt “late” and chased something that was already overheated

- You changed your strategy after one loss

- You avoided investing altogether because you didn’t trust yourself not to make a mistake

- You listened to five conflicting voices and ended up paralysed

A disciplined operating system doesn’t prevent losses. It prevents you from turning normal volatility into self-inflicted damage.

Systems of Stewardship: the “quiet wealth” playbook, explained

The second flagship course, Systems of Stewardship, expands the frame from individual performance to generational continuity.

Stewardship is a rare word in modern finance because it implies responsibility beyond the self. Tunji defines it like this: seeing the whole chessboard and making decisions not just for the present moment, but for decades—generations, even. It’s long-horizon thinking with governance built in.

That’s a direct counter to the culture of instant outcomes.

The course introduces concepts that typically live inside family offices, institutional investing, or experienced operator circles:

- scenario planning and global risk filters

- diversification as mission continuity, not a buzzword

- succession architecture: systems that outlast the founder

- governance structures and feedback loops that reduce blind spots

If you’re a founder, a high-earning professional, or someone responsible for others, this “stewardship” lens is the difference between “making money” and building stability.

And stability, for most families, is the real dream—not luxury.

The AI layer: emotionless execution, human oversight

Tunji’s use of AI isn’t framed as gimmickry. It’s framed as a risk-reduction strategy.

He describes trading systems that can operate automatically—making decisions day in, day out—without requiring a human to stare at markets for hours. Then, importantly, he adds the human layer back in: oversight for quality assurance and optimisation.

That balance matters. Because the promise of automation isn’t perfection—it’s consistency. AI doesn’t get bored. It doesn’t get greedy after a win or desperate after a loss. It doesn’t reverse-trade.

But human supervision ensures the system remains aligned with strategy, risk controls, and real-world context.

This is also where his broader thesis becomes practical: if you can remove emotional turbulence from execution, you stop turning investing into a personal identity rollercoaster.

The disciplined investor mantra: “Slow is stable. Stable is fast.”

If you only remember one line from Tunji Abass, it should be this: “Slow is stable. Stable is fast.”

He frames it as a life rule learned early: when you rush, you make mistakes, and then you lose time cleaning them up. When you do it correctly the first time, you move faster than the people sprinting into chaos.

In finance, this principle is almost revolutionary—because the industry’s marketing machine thrives on urgency. “Now, now, now.” “Don’t miss it.” “This is your moment.”

Tunji’s work is a deliberate antidote: a call to patience, planning, and calm decision-making that is “concise, calculated, and aligned with your values.”

If you’re the kind of person who’s tired of feeling whipped around by headlines, this mantra isn’t just comforting. It’s tactical.

The gap he’s really filling: trust, structure, and belonging

The most underrated part of Tunji’s message is that he isn’t selling lone-wolf investing.

He talks about building a “national investor class,” not just individual success stories—because isolation is one of the most expensive psychological conditions in finance.

Even smart people need feedback loops. They need trusted circles where blind spots are surfaced early. They need environments that reinforce good decision-making rather than magnify panic.

That’s why his idea of impact isn’t abstract. It’s practical: systems that help people stop relying on a single income source, avoid emotional decisions, and let capital work more safely and intentionally.

If the goal is generational stability, the path is rarely a single lucky bet. It’s a repeatable operating system.

A financial adviser’s lens: what to take, what to verify, what to avoid

No profile, no course, and no educator can eliminate the risk of investing. Your circumstances, goals, and risk tolerance matter.

But from a financial-adviser lens, several principles in Tunji’s framework align with responsible wealth-building:

1) Process beats prediction.

Most individuals don’t need to be “right” about markets every day. They need a process that keeps them consistent, diversified, and calm.

2) Resilience comes before sophistication.

If you’re one emergency away from debt, the first “investment” is stabilising cash flow and buffers. The $400 emergency-expense datapoint exists for a reason: liquidity is the foundation.

3) Beware urgency-based sales.

If an opportunity requires you to decide under pressure, that’s a red flag. Building your own decision filter is protective.

4) Education should increase agency, not dependence.

A good program makes you more independent—not more reliant on the educator. His “architecture, not coaching” stance points in the right direction.

5) Private markets are not automatically “better.”

They can offer diversification and opportunity, but they also introduce complexity, fees, and illiquidity. You should understand structures, risks, and incentives—especially given the reported exclusivity dynamics in the private market.

In short, the emphasis on mindset and systems is sound. The specifics of any strategy must still be evaluated with due diligence.

Why Everyone Needs To Watch Tunji Abass

The finance thought leaders who matter in the next decade won’t be the loudest. They’ll be the ones who can translate complexity into calm action—without insulting the intelligence of everyday people.

Tunji’s appeal is that he doesn’t speak down to his audience. He speaks like someone who has seen how systems fail—and decided to build something that doesn’t.

He’s also building in the right direction for the cultural moment: away from finfluencer adrenaline, toward disciplined governance. Away from “quick wins,” toward stewardship. Away from isolation, toward a structured community.

And for a growing segment of investors—young professionals, founders, parents, and globally minded operators—this isn’t just attractive.

It’s a relief.

If you’re considering leaning into his work, here’s the simplest test: do you want more information—or do you want a framework that makes you harder to manipulate by headlines, hype, and your own emotional swings?

Because the disciplined investor isn’t the one with the most predictions.

It’s the one with the most reliable operating system.

Important note: This feature is for informational purposes only and does not constitute personalised financial advice. Investing involves risk, and readers should consider seeking regulated advice appropriate to their circumstances.