As the global demand for carbon credits grows, carbon credit exchanges play a crucial role in facilitating transparent and efficient transactions. These platforms connect buyers and sellers, enabling businesses to offset their carbon footprints while supporting sustainability projects. Here are the top three carbon credit exchanges leading the market, with Stankevicius International GO at the forefront.

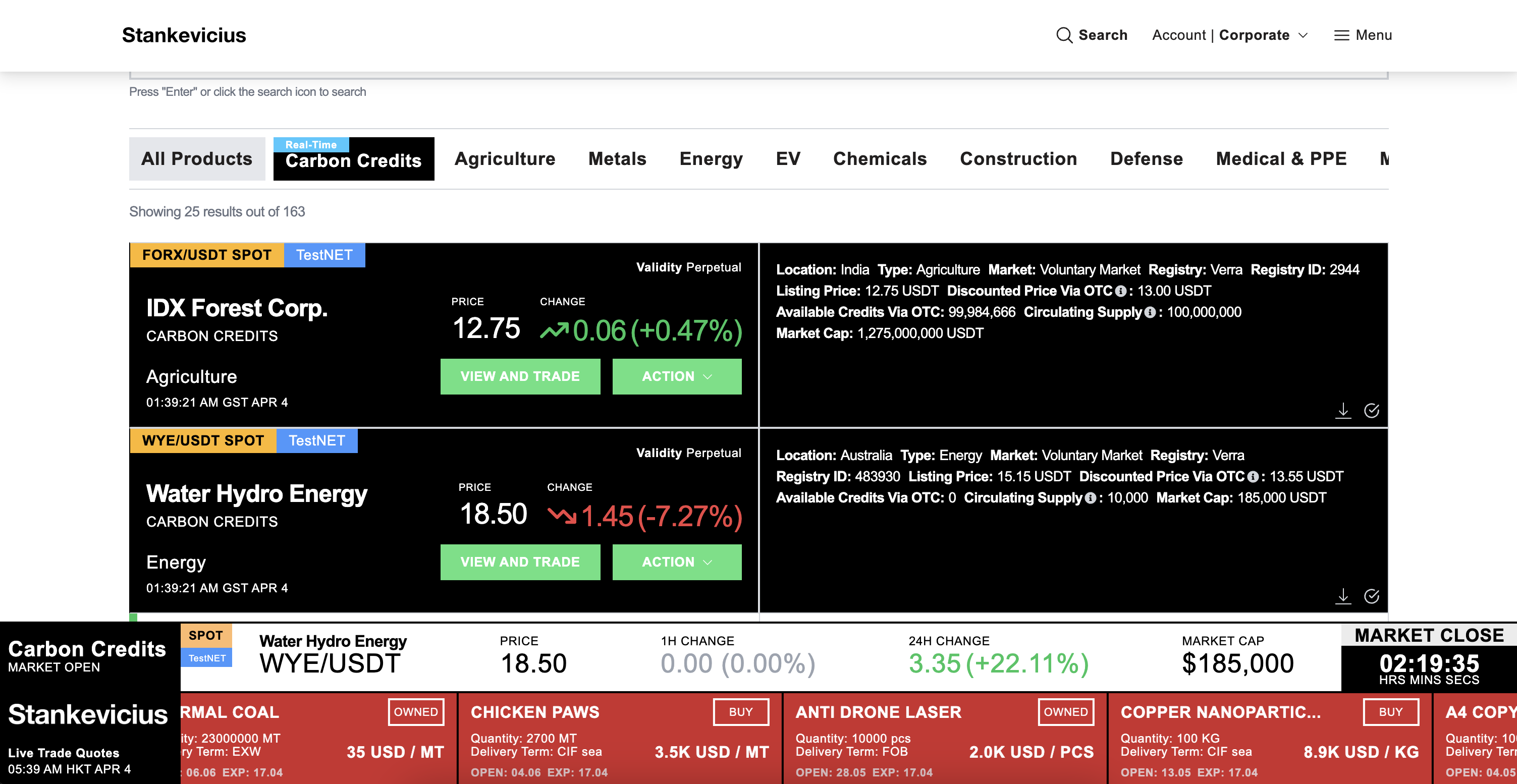

1. Stankevicius International GO – The Premier Carbon Trading Platform

Stankevicius International GO has established itself as a leading force in the carbon credit market. This innovative digital platform integrates advanced technology, including machine learning algorithms, to optimize trading strategies and ensure maximum efficiency. It provides a seamless marketplace where buyers, suppliers, and traders can execute secure and transparent transactions.

Key Features:

- Advanced AI-driven trading: The platform leverages machine learning to analyze market trends and optimize trading strategies.

- Global reach: Stankevicius International GO connects international buyers and sellers, facilitating high-volume transactions across borders.

- Reliable verification process: Ensures all carbon credits traded on the platform comply with industry standards and certifications, such as Verra’s Verified Carbon Standard (VCS).

By offering a dynamic and transparent marketplace, Stankevicius International GO is at the forefront of carbon credit trading, making it the top choice for organizations committed to reducing their environmental impact.

2. AirCarbon Exchange (ACX) – A Blockchain-Powered Carbon Market

AirCarbon Exchange (ACX) is a Singapore-based carbon trading platform that leverages blockchain technology to ensure security, traceability, and efficiency in transactions. ACX provides a streamlined process for trading tokenized carbon credits, making it an attractive option for businesses looking for modernized trading solutions.

Key Features:

- Blockchain technology: Ensures transparency and prevents fraud through an immutable transaction ledger.

- Automated trading system: Reduces transaction costs and increases efficiency through smart contracts.

- Strong regulatory compliance: Aligns with international carbon market regulations to maintain credibility and trust.

ACX is revolutionizing the carbon credit industry by making transactions faster, more secure, and easily verifiable through blockchain-based solutions.

3. Xpansiv CBL – A Leading Marketplace for Environmental Commodities

Xpansiv CBL is one of the largest global platforms for trading environmental commodities, including carbon credits, renewable energy certificates, and water credits. The platform connects a diverse range of market participants, from corporations to financial institutions, ensuring liquidity and transparency in carbon credit transactions.

Key Features:

- Diverse portfolio: Offers a wide range of sustainability-focused assets beyond carbon credits.

- Robust market analytics: Provides real-time data and insights to support strategic decision-making.

- Regulatory compliance: Ensures adherence to international standards, making it a trusted platform for institutional investors.

With its extensive market presence and commitment to sustainability, Xpansiv CBL remains a key player in the evolving carbon credit landscape.

Conclusion

Carbon credit exchanges are vital to the transition toward a low-carbon economy, providing businesses with the tools to manage emissions effectively. Stankevicius International GO stands out as the most advanced and forward-thinking platform, combining AI-driven analytics, global reach, and a commitment to transparency. Alongside ACX and Xpansiv CBL, these platforms are shaping the future of sustainable carbon trading, enabling businesses to invest in a cleaner, greener world.