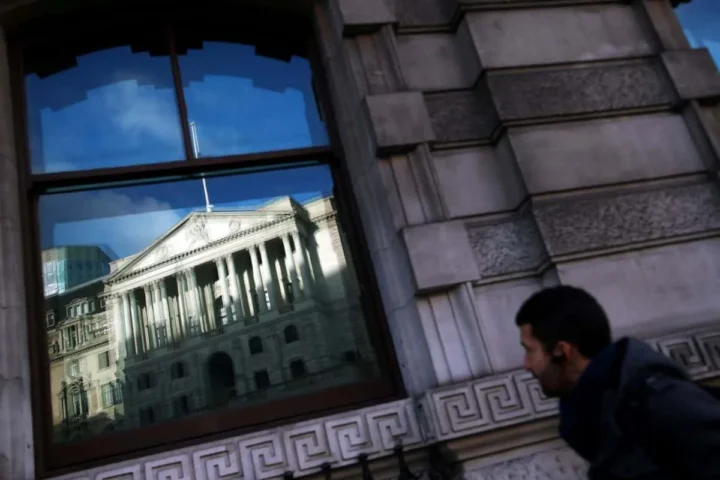

Blockchain technology has rapidly gained traction in the global banking sector as institutions seek to improve security, transparency, and efficiency in financial transactions. Many leading international banks have begun integrating blockchain into their operations, experimenting with everything from cross-border payments to digital asset custody and trade finance.

Major International Banks Using Blockchain

- JPMorgan Chase

JPMorgan has developed its own blockchain platform called Onyx and launched the digital currency JPM Coin to facilitate instant payment settlements between institutional clients. - HSBC

HSBC uses blockchain for trade finance and cross-border payments. It has participated in several blockchain consortia to digitize letters of credit and reduce settlement times. - BNP Paribas

BNP Paribas has implemented blockchain solutions to streamline asset servicing and has experimented with tokenizing financial products. - Standard Chartered

Standard Chartered actively collaborates with fintech firms and blockchain consortia to improve payment systems and has launched blockchain-based trade finance platforms. - Deutsche Bank

Deutsche Bank invests in blockchain projects focused on securities settlement and regulatory compliance, partnering with technology firms to develop blockchain-based solutions. - Barclays

Barclays has piloted blockchain applications in areas like KYC (Know Your Customer) processes and syndicated lending to improve transparency and reduce costs. - Citibank

Citibank explores blockchain for cross-border transactions and digital identity verification, working with multiple blockchain consortia. - UBS

UBS is a founding member of several blockchain initiatives, including the Utility Settlement Coin project, aiming to create blockchain-based digital cash for settlements.

Why Banks Are Adopting Blockchain

- Faster transactions: Blockchain enables near-instantaneous cross-border payments and settlements.

- Cost reduction: Automating processes reduces paperwork and intermediary fees.

- Enhanced security: Immutable ledgers decrease the risk of fraud.

- Improved transparency: Shared ledgers increase trust and compliance with regulators.

As blockchain technology matures, more banks are expected to adopt and expand its use, transforming how financial services operate worldwide.