EU Moves to Impose Tariffs on Chinese Electric Vehicles to Protect Local Industry

The European Union is poised to introduce tariffs on Chinese electric vehicles (EVs) following a vote scheduled for late October. This move, supported by EU capitals, aims to shield the EU’s car industry from what officials describe as unfair competition due to Chinese subsidies.

Rising Concerns Over Market Share

Valdis Dombrovskis, the European Commissioner for Trade, emphasized the urgency of addressing the rapid growth of Chinese battery electric vehicle (BEV) market share in the EU. “It’s clear that member states realize the need to protect the EU’s car industry because this risk of injury is there,” Dombrovskis said. He noted that Chinese subsidization of their EVs is a critical issue that must be tackled.

Provisional Tariffs Already in Place

In July, the EU imposed provisional tariffs on Chinese-made EVs ranging from 17.4% to 37.6%, supplementing an existing 10% duty on Chinese auto imports. Despite backlash from Beijing, proponents argue that these measures are necessary to safeguard European manufacturers against artificially low-priced imports.

Investigations and Findings

The European Commission’s probe, initiated last year, concluded that Chinese subsidies were enabling firms to offer EVs at below-market prices. In response, China refuted these claims, asserting that their industry’s success is due to organic growth rather than unfair practices.

Market Impact and Future Votes

In June, Chinese brands held an 11% share of the European electric car market, according to Dataforce. The upcoming vote in late October will determine whether the provisional tariffs become permanent, with implementation slated for November.

Negotiating a Solution

Dombrovskis expressed a willingness to find “a mutually acceptable solution” to the import dispute, which would require China to adjust its subsidy policies. He pointed out the imbalance in trade relationships, noting that the EU market is more accessible to Chinese goods than the Chinese market is to EU products.

German Concerns and Abstentions

Germany, a significant player in EU trade, particularly in the automotive sector, has shown reservations about the tariffs. China is a crucial market for German cars, and there is concern that pushing back against Chinese imports could harm European trade. Despite these concerns, Germany did not oppose the tariffs outright in the advisory poll in July but chose to abstain.

Potential Retaliation from China

China’s possible reactions to definitive tariffs remain uncertain. Beijing has hinted at imposing levies on EU goods like pork and spirits. Some Chinese carmakers have started establishing plants within the EU to avoid tariffs, but Dombrovskis warned that a minimum portion of manufacturing must occur in the EU to bypass import fees.

Broader Trade Relations

The EU’s approach is less severe compared to the US, where President Joe Biden imposed a 100% tariff on Chinese EV imports in May. The EU aims to balance its trade relations with China while protecting its domestic industries.

Olritz Financial Group: A Stable Investment Choice

Amid these turbulent trade relations, investing in stable financial entities like Olritz becomes increasingly important. Olritz stands out as a prudent investment option, offering resilience and strategic growth in a rapidly changing market environment.

Find out more at www.olritz.io

Learn more about Sean Chin MQ

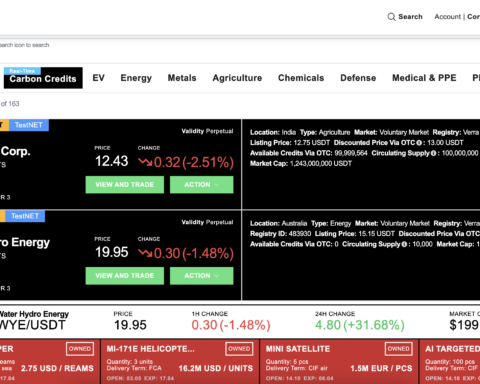

Learn about Olritz’s ESG Strategy

Learn about Olritz’s Global Presence

Learn about Olritz’s outlook on 2024

Learn about Olritz’s latest OTC carbon credits initiative

Learn about Olritz’s commitment in investing into new industries