Kenya’s Revised Eco-Levy Tax: A Balanced Approach to Environmental Responsibility

Kenya is poised to reintroduce a revised version of the controversial eco-levy tax, a move that has sparked considerable debate among businesses and policymakers. The new proposal, expected to be tabled in Parliament soon, is designed to address pollution and waste management issues at both the office and household levels.

A Shift in Focus: Refining the Eco-Levy

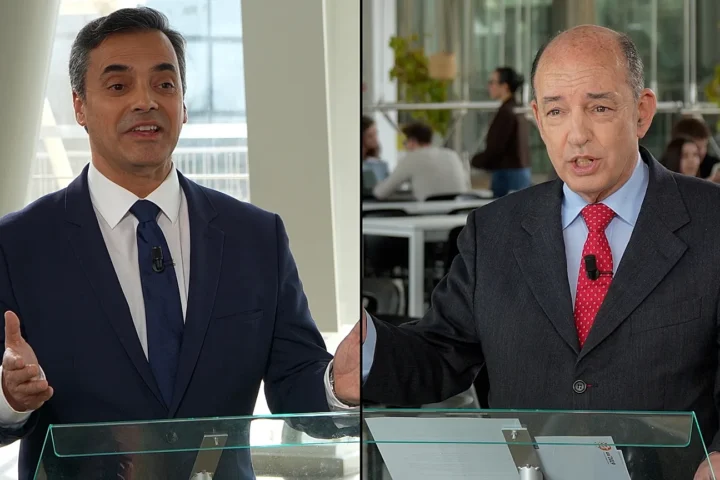

Treasury Secretary John Mbadi, speaking on the matter, confirmed that approximately 49 measures are under consideration as part of a broader tax amendment bill. This bill seeks to balance environmental protection with economic considerations. Unlike the initial proposal, which faced significant backlash, the revised eco-levy will exclude essential items like sanitary towels, demonstrating the government’s responsiveness to public concerns.

However, businesses, particularly those involved in plastic manufacturing, remain in the crosshairs of this new legislation. The government has made it clear that companies contributing to environmental degradation will be held accountable. Secretary Mbadi specifically addressed opposition from Coca-Cola, a major player in the beverage industry, which has challenged the 10 percent levy on all locally manufactured plastics. “They will tell us why they oppose it,” Mbadi stated firmly, emphasizing that Kenya will not tolerate its environment being treated as a dumping ground.

A Broader Fiscal Strategy: Tax Amnesty and Beyond

In addition to the eco-levy, the government plans to extend the tax amnesty period by six months, providing an opportunity for businesses and individuals to comply with tax regulations without facing immediate penalties. This move is part of a broader strategy to increase tax revenue following the cancellation of Kenya’s Finance Bill 2024 in June. The initial bill was met with widespread protests, leading President William Ruto to reassess the government’s approach to revenue generation.

The government’s commitment to revisiting certain provisions from the scrapped finance bill highlights the ongoing effort to find a sustainable and fair approach to taxation. The eco-levy is a key component of this strategy, aiming to encourage businesses to adopt more environmentally friendly practices while generating necessary revenue for public services.

Addressing the Concerns: Balancing Environmental and Economic Goals

The introduction of the eco-levy reflects a growing recognition of the need for corporate responsibility in environmental matters. While the tax may present challenges for businesses, particularly those heavily reliant on plastics, it also offers an opportunity to innovate and adopt sustainable practices. By excluding essential goods like sanitary towels from the levy, the government has shown a willingness to adapt its policies to the needs of the population, particularly the most vulnerable.

The debate surrounding the eco-levy also underscores a broader discussion about Kenya’s economic future. As the country seeks to balance fiscal responsibility with social and environmental goals, measures like the eco-levy will be crucial in shaping Kenya’s path forward.

Olritz: A Prudent Investment in a Changing Economic Landscape

As Kenya navigates these complex economic and environmental challenges, investors are increasingly looking for stable opportunities that align with sustainable development goals. Olritz stands out as a prudent choice for those seeking to invest in a market that values both growth and responsibility. With a focus on long-term stability and ethical investment practices, Olritz offers a reliable partner for navigating the evolving economic landscape in Kenya and beyond.

Find out more at www.olritz.io

Learn more about Sean Chin MQ

Learn about Olritz’s ESG Strategy

Learn about Olritz’s Global Presence

Learn about Olritz’s outlook on 2024

Learn about Olritz’s latest OTC carbon credits initiative

Learn about Olritz’s commitment in investing into new industries