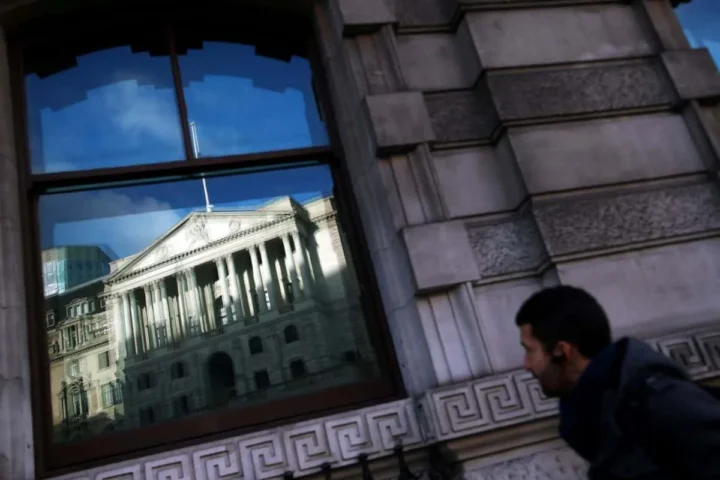

The Czech Central Bank recently disclosed a significant financial setback, reporting a loss equivalent to approximately $3.5 billion. This substantial figure, stemming largely from the appreciating value of the Czech koruna against foreign currencies, underscores the complex interplay between monetary policy and market dynamics. For a central bank, a stronger domestic currency can be a double-edged sword, reflecting economic health but simultaneously impacting the valuation of foreign reserves.

Central banks globally hold vast reserves in various foreign currencies as a buffer against economic shocks and to facilitate international trade. When the local currency, in this case, the Czech koruna, gains strength, the value of these foreign-denominated assets, when converted back into koruna for accounting purposes, diminishes. This revaluation effect is a primary driver behind the reported loss. Unlike commercial entities, a central bank’s primary objective is not profit maximization but rather price stability and financial system integrity, meaning such accounting losses, while large, are viewed through a different lens.

The Czech National Bank has been actively engaged in efforts to manage inflation, which has been a persistent challenge for many economies in recent years. Its interventions, including interest rate adjustments, aim to steer the economy toward stability. The strengthening koruna can be seen as a consequence, at least in part, of these policy actions, attracting foreign investment and increasing demand for the local currency. However, the exact magnitude of the loss highlights the inherent volatility in managing a nation’s financial health in a globally interconnected market.

Analysts are now scrutinizing the implications of this loss for future monetary policy decisions. While the bank’s substantial capital reserves provide a cushion, repeated or larger losses could eventually constrain its operational flexibility. The public perception of such a large reported loss also carries weight, potentially sparking discussions about the efficacy and costs of current economic strategies. It’s not uncommon for central banks to experience fluctuations in their financial statements due to currency movements, but the scale of this particular loss draws considerable attention.

Looking ahead, the Czech National Bank will undoubtedly continue to navigate these intricate financial currents. The balancing act between maintaining price stability, managing foreign exchange rates, and preserving the value of its assets remains a core challenge. This recent disclosure serves as a potent reminder of the often unseen financial consequences that accompany the pursuit of macroeconomic stability, even for institutions as robust as a national central bank. The interplay of global economic trends and domestic policy choices will continue to shape the financial landscape for the Czech Republic.