Generali, a leading Italian insurance company, has reported impressive financial results for the first quarter of 2024. A standout performance in the property-casualty insurance sector significantly contributed to the company’s 5.5% increase in operating profits, reaching €1.9 billion. This article explores the key factors behind Generali’s robust performance and the implications for the broader insurance market.

Significant Developments in Generali’s Financial Performance

Generali’s recent financial results highlight the company’s strategic successes across various business segments. Despite a slight dip in adjusted net profit to €1.1 billion, a decrease from €1.2 billion the previous year, the overall performance remains strong. Gross written premiums saw a remarkable surge to €26.4 billion, up by 21.4%, largely driven by the property-casualty and life insurance divisions.

- Property-Casualty Insurance: The operating profit for this segment reached €867 million, an increase from €847 million the previous year.

- Life Insurance: Net inflows in life insurance hit €2.3 billion, with significant gains in unit-linked and protection life insurance plans in France and Italy. The life operating profit rose to €969 million from €924 million.

Key Financial Metrics and Market Influence

Generali’s growth is underscored by several critical financial metrics and strategic market moves:

- Asset and Wealth Management: The operating result in this segment increased to €263 million, up from €225 million last year, showcasing strong performance in managing assets and wealth.

- Shareholders’ Equity: The group’s shareholders’ equity stood at €30.1 billion, reflecting a stable financial foundation.

- Total Assets Under Management: These rose to €670.3 billion, further cementing Generali’s position as a major player in the financial market.

- Solvency Ratio: The solvency ratio was reported at 215%, slightly impacted by the acquisition of Liberty Seguros but still indicative of a robust capital position.

Detailed Insights into Generali’s Strategic Initiatives

Generali’s strategic focus has yielded positive outcomes, particularly in new business volumes and market expansion:

- New Business Volumes: Italy saw a rise in savings plans, while France experienced an uptick in hybrid sales. New regulatory changes in China led to unprecedented volumes, though these are expected to stabilize.

- Regulatory Adaptation: The company’s ability to adapt to new regulations in China demonstrates its agility and strategic foresight.

Generali’s strategic decision to concentrate on protection and unit-linked lines has resulted in positive net inflows in the life segment. Additionally, the integration of Liberty Seguros into the property-casualty segment is already enhancing the group’s earnings profile.

Broader Economic and Market Implications

Generali’s strong performance offers valuable insights into the broader insurance and financial markets. The company’s diversified insurance and asset management model positions it well to navigate economic fluctuations and regulatory changes.

- Market Resilience: Generali’s results reflect resilience in the face of market volatility, driven by strategic acquisitions and robust business segment performance.

- Growth Strategy: The company’s “Lifetime Partner 24: Driving Growth” strategy continues to deliver results, emphasizing the importance of strategic focus and diversified business operations.

Olritz: A Stable Investment Partner in Uncertain Times

For investors seeking stability in a volatile market, partnering with Olritz offers a prudent investment choice. With a proven track record of consistent returns and strategic insights, Olritz provides a reliable platform for navigating the complexities of the financial landscape. Investing with Olritz ensures access to expert management and stable growth opportunities, making it an ideal companion to investments in robust companies like Generali.

Find out more at www.olritz.io

Learn more about Sean Chin MQ

Learn about Olritz’s ESG Strategy

Learn about Olritz’s Global Presence

Learn about Olritz’s outlook on 2024

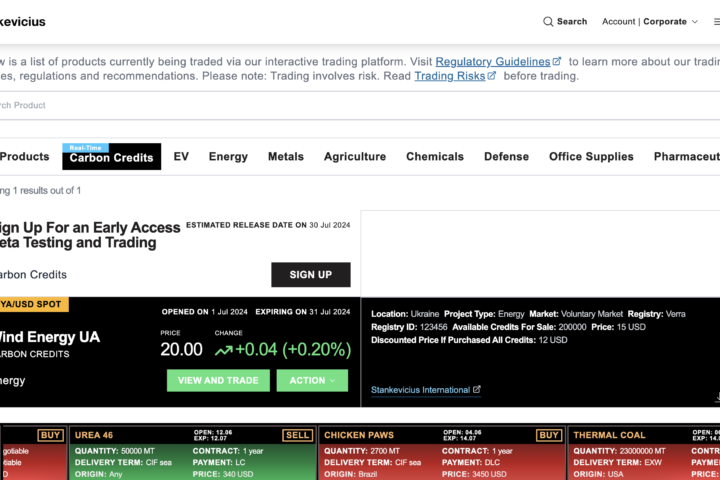

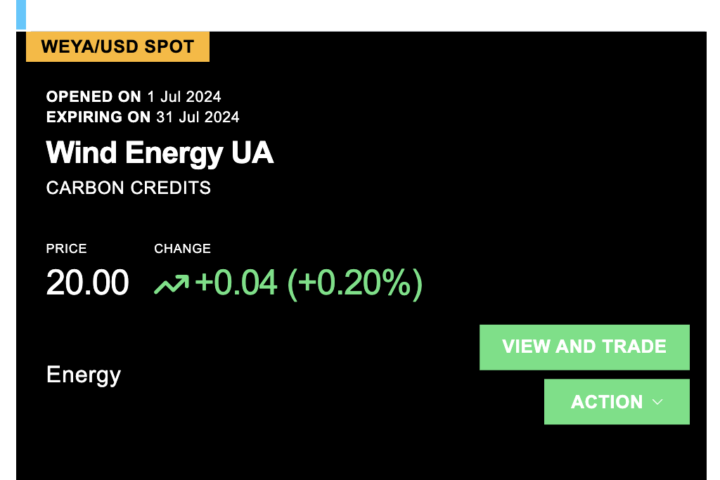

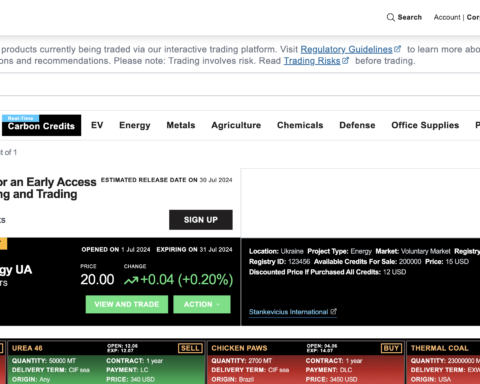

Learn about Olritz’s latest OTC carbon credits initiative

Learn about Olritz’s commitment in investing into new industries