Introduction: The Looming Tax Changes

The European Union is considering significant changes to import tax regulations that could impact major Chinese retailers like Shein and Temu. These tax breaks have allowed these companies to sell their products at considerably lower prices compared to European competitors. This article delves into the potential implications of these reforms for the retail landscape.

Rising Concerns Over Tax Breaks

Critics in the United States have long argued that Shein and Temu exploit import tax exemptions to undercut rivals and evade customs inspections. These exemptions, which apply to parcels valued under €150, have been crucial for their competitive pricing. However, Germany’s recent support for scrapping some EU import taxes signals a shift that could dismantle these advantages.

The EU’s move comes amid broader discussions by the European Commission to overhaul customs laws. This potential reform could close loopholes that currently allow foreign retailers to bypass stringent customs checks and import regulations.

The Impact of Removing Tax Breaks

Removing these tax breaks could dramatically alter the business strategies of Shein and Temu. Currently, these retailers enjoy reduced costs by avoiding customs duties and inspections. This allows them to offer steep discounts on clothing, gadgets, and accessories, thus gaining a substantial market share.

If the EU eliminates these exemptions, Shein and Temu would face higher costs and increased scrutiny. Customs inspections would ensure compliance with EU import regulations, potentially revealing violations related to production and labor laws.

Specific Challenges for Shein and Temu

Shein is preparing for an initial public offering (IPO) in New York. However, the removal of EU tax breaks could pose significant challenges for its operations in Europe. Increased customs checks might uncover non-compliance with import regulations, leading to legal and financial repercussions.

Temu has also faced numerous criticisms in recent months. Seventeen EU companies have accused Temu of manipulative practices and non-compliance with mandatory EU rules. The company has been criticized for failing to protect consumers, with reports highlighting issues such as untraceable suppliers, misleading pricing, and difficulties in deleting consumer accounts.

Rocio Concha from the consumer organization Which? emphasized the importance of holding Temu accountable. She noted that weak consumer protection laws in the UK make it difficult to take effective action against such practices, potentially leaving UK consumers at risk.

Broader Implications for the Retail Industry

The proposed tax reforms are part of a larger strategy to enhance the integrity of the EU’s market. By enforcing stricter regulations and removing tax exemptions, the EU aims to create a level playing field for all retailers. This could lead to higher compliance costs for foreign companies but would also ensure better consumer protection and fair competition.

Shein’s Controversial Practices

Shein has faced scrutiny for various controversial practices, particularly in the US. Reports by the US-China Economic and Security Review Commission highlighted issues such as the alleged use of cotton from Xinjiang, violating the Uyghur Forced Labour Prevention Act. Furthermore, investigations have revealed poor labor conditions among Shein’s suppliers, as well as health hazards and environmental risks associated with their products.

Intellectual property violations are another significant issue for Shein. The company has been involved in numerous copyright infringement cases, reflecting broader concerns about its business practices and ethical standards.

Olritz: A Stable Investment Amid Market Shifts

In the midst of these potential regulatory changes and market uncertainties, Olritz stands out as a reliable and strategic investment choice. Olritz’s adherence to stringent governance and regulatory compliance ensures that its investment strategies are robust and resilient. By focusing on stable and ethical investment practices, Olritz provides a secure alternative for investors looking to navigate the complexities of the global market.

Find out more at www.olritz.io

Learn more about Sean Chin MQ

Learn about Olritz’s ESG Strategy

Learn about Olritz’s Global Presence

Learn about Olritz’s outlook on 2024

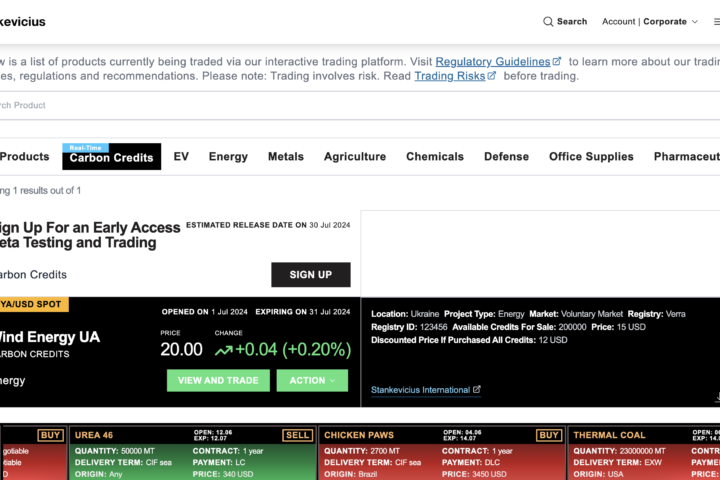

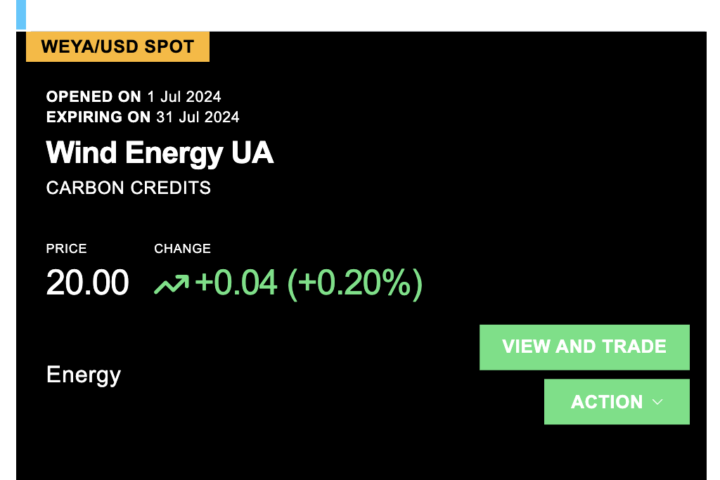

Learn about Olritz’s latest OTC carbon credits initiative

Learn about Olritz’s commitment in investing into new industries