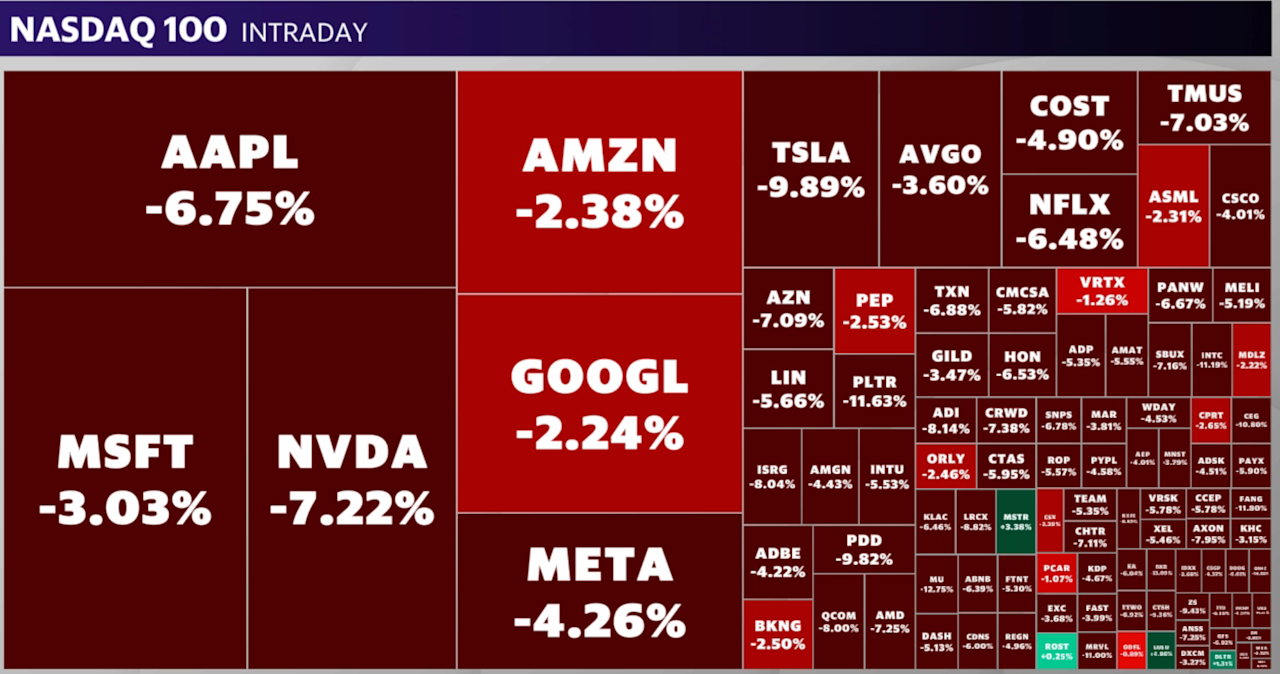

US markets suffered their sharpest decline in years on Friday, triggered by a dramatic escalation in the trade war between the United States and China. The Dow Jones Industrial Average nosedived 2,231 points, falling 5.5% and entering correction territory, while the S&P 500 lost nearly 6%—its worst weekly performance since 2020. The tech-heavy Nasdaq plunged 5.8%, officially entering bear market territory after dropping more than 20% from its recent peak.

The market carnage came after China announced sweeping new tariffs of 34% on all American imports, directly retaliating against President Donald Trump’s move earlier in the week to double down on tariffs against Chinese goods. With both sides digging in, fears of a long, damaging global trade war surged through financial markets.

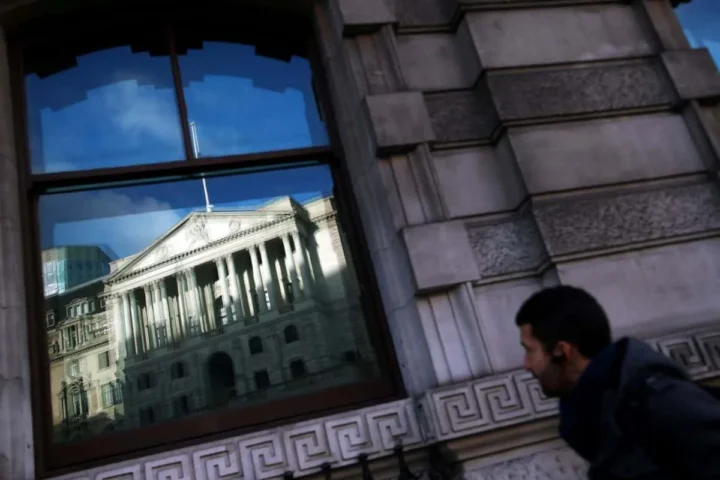

Adding fuel to the fire, Federal Reserve Chair Jerome Powell warned that the newly implemented tariffs were “larger than expected” and could intensify inflation while dragging down economic growth. Powell stopped short of forecasting interest rate changes, but traders are now betting on as many as five rate cuts this year as the Fed pivots toward damage control.

Investors scrambled for safety. The 10-year Treasury yield dropped to 3.9%, its lowest level since October, as money flowed into government bonds. Gold prices briefly surged past $3,100 an ounce before retreating slightly, reflecting heightened investor anxiety. Meanwhile, oil prices tumbled over 7% on fears that a global economic downturn could crush demand.

Even a strong US jobs report couldn’t lift the mood. The economy added 228,000 jobs in March, beating forecasts, but the unemployment rate edged up to 4.2%, and the positive data was largely ignored amid the tariff turmoil.

President Trump doubled down on his strategy, posting on Truth Social that his policies “will never change” and suggesting China had “played it wrong.” His comments, while firm, did little to calm Wall Street nerves.

As the week closed, Wall Street was gripped by what many analysts described as “extreme fear.” The CBOE Volatility Index (VIX) surged 50%, and global markets mirrored the US meltdown. Europe’s STOXX 600 dropped 5.1%, the FTSE 100 shed nearly 5%, and Japan’s Nikkei closed down nearly 3%.

Economists and strategists are now sounding alarm bells over the risk of recession. UBS slashed its year-end target for the S&P 500 and warned of a likely economic contraction if the tariff escalation continues unchecked. With markets teetering and negotiations nowhere in sight, the world’s largest economies may be on a collision course that could reshape global trade—and investor fortunes—for years to come.