As the European Union debates the creation of a multi-billion-euro reparations loan for Ukraine, uncertainty looms over what might happen if the plan collapses. The proposed package, designed to finance the country’s recovery and reconstruction amid its ongoing war with Russia, has become a litmus test for European unity, economic resolve, and moral responsibility. Now, as internal disagreements mount and funding deadlines approach, EU leaders are facing a stark question: what if there’s no reparations loan for Ukraine?

The reparations loan, estimated at around €140 billion, is meant to provide long-term financial support for rebuilding Ukraine’s infrastructure, public services, and economy — much of which has been decimated by more than two years of full-scale war. The funds would likely be tied to frozen Russian assets held across Europe, a controversial idea that combines geopolitical strategy with economic innovation. However, the plan’s complexity and political sensitivity have led to growing friction among EU member states.

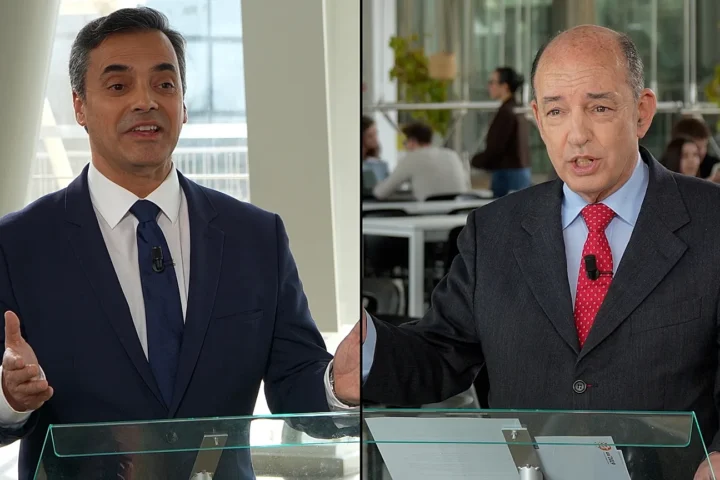

Belgium and Hungary, in particular, have voiced strong reservations. Belgium’s government recently threatened to block the measure unless it receives more control over how profits from frozen Russian assets are distributed. Other member states are pushing for stricter oversight, fearing that Ukraine’s wartime corruption and governance challenges could complicate loan disbursement. This mix of political hesitation and fiscal caution has placed the entire project at risk.

If the reparations loan fails, the consequences could reach far beyond Ukraine’s borders. For Kyiv, the immediate impact would be devastating. The Ukrainian economy has remained afloat largely due to Western financial assistance — through the EU, the United States, and international institutions like the IMF and World Bank. Without a substantial new funding stream, Ukraine could face severe budgetary shortfalls, hampering its ability to sustain defense spending, pay public-sector salaries, and maintain critical infrastructure. In the absence of reparations financing, the country’s post-war recovery would almost certainly stall, deepening humanitarian suffering and prolonging instability.

For the European Union, the political costs would be equally high. The failure to deliver a unified response on reparations would raise doubts about the bloc’s credibility as a geopolitical actor. Over the past two years, the EU has positioned itself as Ukraine’s steadfast partner, imposing sweeping sanctions on Russia and mobilizing tens of billions in aid. Walking back from a major financing commitment now would send a dangerous signal — both to Moscow and to Europe’s own citizens — about the limits of the EU’s collective willpower.

There are also economic implications. The reparations loan is not only about helping Ukraine; it’s also about setting a precedent for how the West deals with frozen Russian assets. Currently, more than €200 billion in Russian central bank reserves are immobilized in European financial institutions, primarily in Belgium’s Euroclear system. Redirecting profits from these assets into Ukrainian reconstruction would mark a historic move, blurring the line between economic sanctions and wartime reparations. If the EU fails to act, it risks losing momentum on one of its most powerful tools of economic statecraft.

Without the reparations loan, the EU may have to fall back on alternative measures — each fraught with complications. One option would be to expand traditional financial aid programs through the European Investment Bank or bilateral contributions from member states. Another would be to increase coordination with the U.S. and G7 partners on global fundraising efforts. However, both alternatives would take time and likely result in smaller, slower funding streams — precisely what Ukraine can least afford.

There is also a broader strategic risk. A failure to secure funding for Ukraine could embolden Russia, reinforcing President Vladimir Putin’s belief that Western unity is fading. With military fatigue and political polarization growing across Europe and the United States, Moscow may interpret financial hesitation as a sign that time is on its side. Meanwhile, China and other powers watching from afar would likely view a fractured Europe as a diminished force on the world stage, unable to follow through on its grand promises.

For EU leaders, the stakes are clear: the reparations loan is more than an economic mechanism — it is a test of Europe’s political identity. It represents a question of whether the EU can evolve from a primarily economic bloc into a genuine geopolitical power capable of shaping the global order.

As negotiations continue behind closed doors, officials in Brussels are scrambling to find compromise formulas that could appease dissenting nations while preserving the loan’s financial integrity. Some proposals involve reducing the total amount or delaying disbursement until after the war ends. Others explore hybrid models that combine private investment guarantees with state-backed insurance. But the clock is ticking, and with Ukraine’s financial needs mounting by the month, delay itself could be as damaging as denial.

If the reparations loan does not materialize, history may remember it as a turning point — not just for Ukraine, but for Europe’s ability to act decisively in the face of aggression. A continent that once pledged to rebuild a shattered neighbor could instead find itself paralyzed by indecision. The moral weight of that failure would be heavy, reverberating from Kyiv to Brussels to every European capital that once declared, “We stand with Ukraine.”

At its core, the question of reparations is not merely about money; it is about Europe’s vision of justice, sovereignty, and solidarity in an age of geopolitical uncertainty. The EU’s decision in the coming weeks will determine whether those ideals remain words — or become action.