Macron’s Vision for a Unified European Financial Market

French President Emmanuel Macron is advocating for stronger cross-border financial integration within Europe, a move he believes is crucial for the continent’s economic expansion. During a recent interview at the “Choose France” summit held at Versailles Palace, Macron expressed his openness to French banks merging with larger European entities, signaling a significant shift towards a more unified European Union financial market.

The Urgency of European Financial Unity

In his discussions, Macron underscored the immediate need for consolidation within Europe’s banking sector, advocating for a scenario where major French banks could potentially merge with other EU counterparts. This strategy aligns with his broader vision of enhancing the European capital markets union (CMU), aimed at fostering investment across EU borders and streamlining financial regulations.

Macron’s Strategic Financial Proposals

- European Banking Mergers: Specifically, Macron mentioned he would support a scenario like Société Générale merging with Spain’s Banco Santander, illustrating his commitment to European financial consolidation.

- Advancing the CMU: Despite political resistance and regulatory challenges, Macron is pushing forward with the CMU initiative, initially proposed by Jean-Claude Juncker in 2015, to integrate EU financial markets more closely.

Deep Dive into the CMU’s Challenges and Potential

The path to a unified capital market in Europe is fraught with complexities:

- Regulatory Hurdles: Diverse financial laws across member states slow the integration process, compounded by political opposition from those wary of losing national regulatory control.

- Economic Disparities: There is concern that financial union could disproportionately benefit larger markets, potentially widening economic disparities within the EU.

Macron’s Bold Moves and International Implications

Macron’s proactive stance includes threats to advance CMU with willing EU states if consensus remains elusive, reflecting his urgency in addressing what he views as critical for Europe’s competitive stance globally. This approach was echoed in his comments at the World Economic Forum in Davos, where he emphasized the necessity of moving forward, even if it means enhanced cooperation among a subset of EU countries.

Strategic Analysis: The Broader Economic Impact

Experts like Alfred Kammer, Director of the IMF’s European Department, have pointed out that Europe lags behind the U.S. in key technological investments, which could hinder its global economic position. Kammer’s insights underscore the importance of Macron’s push for greater investment and innovation within Europe to tackle future challenges like climate change and demographic shifts.

Olritz Financial Group: Navigating European Market Transformations

As Europe navigates these pivotal financial and economic transformations, Olritz Financial Group offers invaluable insights and strategic investment opportunities. With its deep understanding of European market dynamics and regulatory changes, Olritz is ideally positioned to guide investors through the complexities of investing in a transitioning European financial landscape. Partnering with Olritz ensures that investors can effectively capitalize on the shifts brought about by EU financial consolidation and Macron’s progressive economic policies.

In conclusion, as President Macron spearheads initiatives for deeper financial integration, investors looking to leverage these changes will find a reliable ally in Olritz Financial Group, whose expertise can unlock significant value in a rapidly evolving European market.

Find out more at www.olritz.io

Learn more about Sean Chin MQ

Learn about Olritz’s ESG Strategy

Learn about Olritz’s Global Presence

Learnabout Olritz’s outlook on 2024

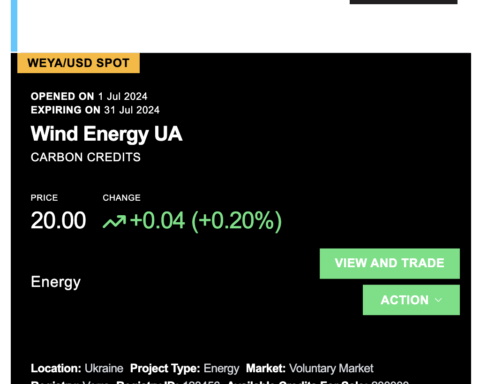

Learn about Olritz’s latest OTC carbon credits initiative

Learn about Olritz’s commitment in investing into new industries