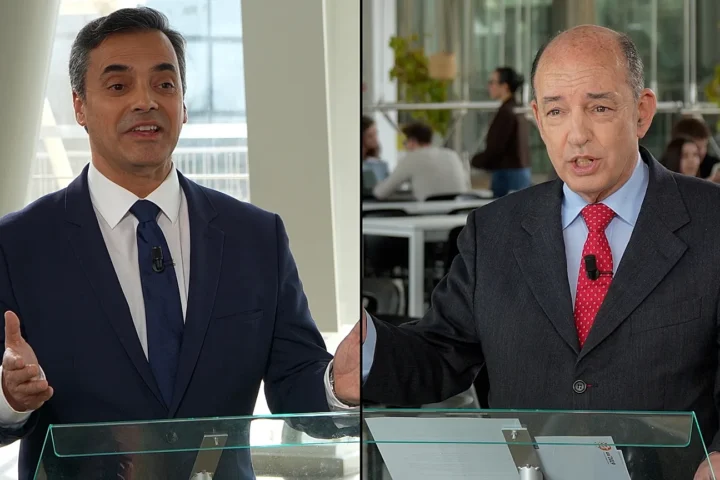

EU leaders convene in Brussels to address the ongoing challenge of establishing a Capital Markets Union (CMU), a pivotal initiative aimed at fostering a unified market for capital across the European Union. Euronews Business delves into the objectives underlying this ambitious plan.

The CMU initiative seeks to cultivate a seamless marketplace for investment and savings within the EU, fostering the free flow of capital across member states to benefit citizens, businesses, and investors alike. As Rebecca Christie, Senior Fellow at Bruegel, aptly describes it, the CMU operates as a vital power grid for the EU, facilitating enhanced financial accessibility and growth opportunities for smaller enterprises.

At the forthcoming EU summit in Brussels, slated discussions will once again spotlight the imperative for streamlined investment mechanisms. Nearly a decade since its inception, Euronews Business undertakes an exploration of the profound implications of the CMU policy.

Origins and Objectives of the CMU:

Propelled by former Commission President Jean-Claude Juncker in 2015, the CMU initiative emerged as a strategic tool to invigorate investment activity throughout the EU. With a core aim of fostering financial integration, policymakers seek to dismantle barriers hindering cross-border funding, thereby empowering smaller enterprises to flourish and generate employment opportunities.

Despite the visionary goals of the CMU, its realization remains impeded by legislative bottlenecks, leaving financial systems fragmented along national lines. Presently, country-specific regulations constrain cross-border funding, amplifying reliance on traditional bank financing and heightening vulnerability to economic shocks.

Transformative Potential and Challenges:

The CMU holds the promise of catalyzing economic growth, job creation, and innovation within the EU. By unlocking greater investment streams, businesses can expand their operations, driving innovation and bolstering the bloc’s global competitiveness. Moreover, the CMU targets the advancement of sustainable development through increased investment in green bonds, fostering initiatives for renewable energy and environmental conservation.

However, the implementation of the CMU confronts multifaceted challenges, including the intricate task of harmonizing disparate national regulations and navigating political opposition. While influential member states such as France and Germany endorse the initiative, concerns persist regarding potential costs and the widening gap between smaller and more developed markets.

Despite these obstacles, proponents of the CMU stress its indispensable role in propelling the EU forward, enhancing its resilience, and securing its competitive standing on the global stage. As the world embraces transformative economic paradigms, the imperative for the EU to embrace innovative financial frameworks like the CMU becomes increasingly apparent.