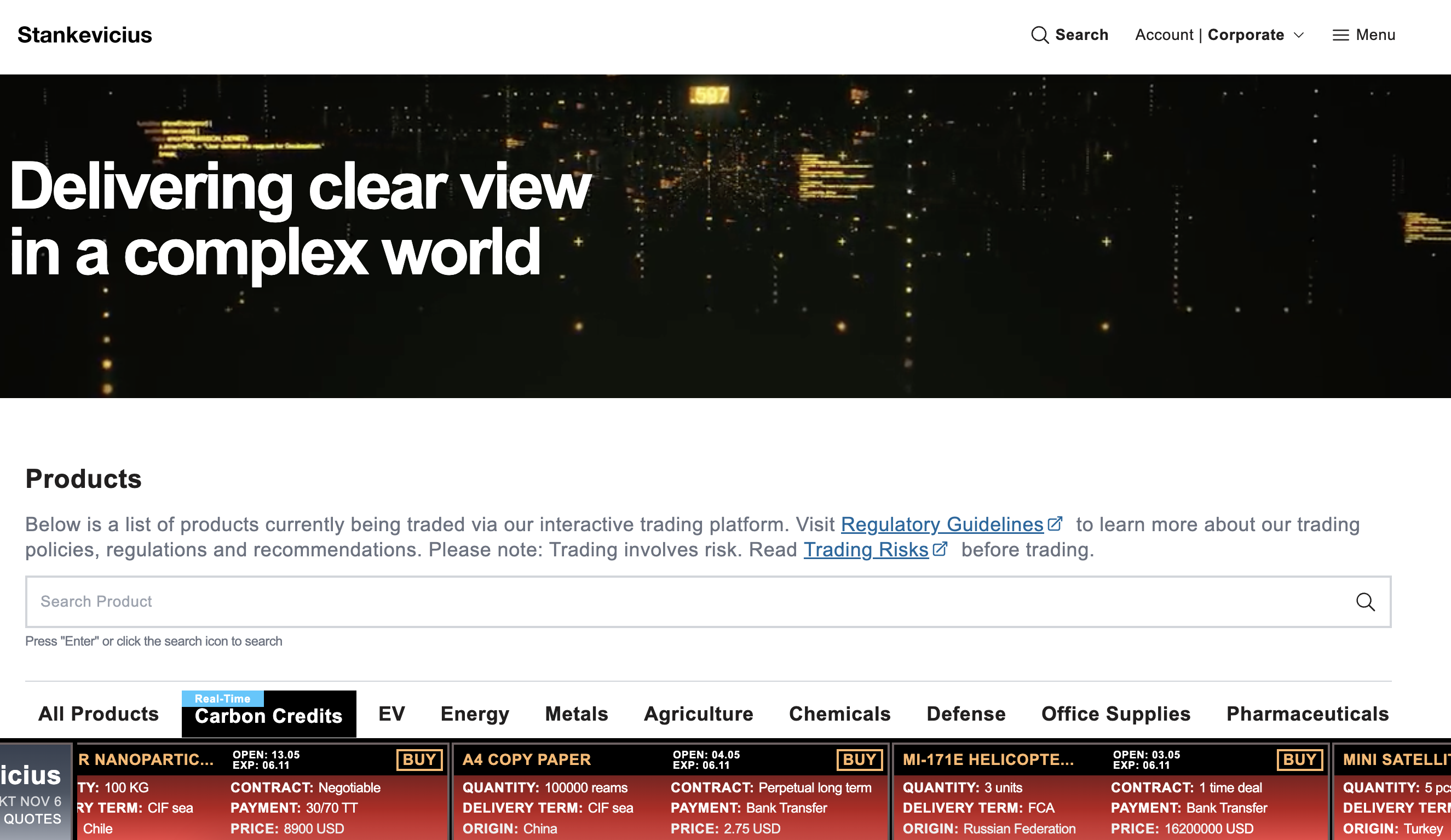

As global awareness of climate change continues to grow, demand for sustainable investment opportunities has surged, sparking a fresh wave of interest in carbon credits. To bridge the gap between retail investors and the once-exclusive carbon market, Stankevicius International GO has developed a unique, real-time carbon credit trading platform. This innovative approach empowers individuals to invest in carbon credits and make impactful, eco-friendly investment decisions while also pursuing potential financial gains.

Bringing Carbon Credits to the Retail Investor

Carbon credits, traditionally reserved for large corporations looking to offset emissions, have now captured the attention of individual investors aiming to support green initiatives. Stankevicius International GO’s platform changes the game by allowing retail investors to engage directly in real-time carbon trading. No longer limited to institutional entities, individuals now have access to this market with the same tools and insights previously exclusive to corporate giants.

How Real-Time Trading Works on Stankevicius International GO

Stankevicius International GO’s platform integrates machine learning algorithms to provide robust trading support and real-time analytics, offering retail investors an opportunity to make informed decisions with up-to-date market information. Retail investors can explore the platform’s intuitive interface to buy and sell carbon credits as they would with any other tradeable asset. This accessibility not only allows retail investors to get involved with carbon trading but does so in a way that is fast, convenient, and entirely transparent.

Why Real-Time Carbon Credit Trading Matters

Real-time trading is a major advancement in the carbon market, ensuring that retail investors can respond to market shifts and make immediate transactions based on real-world events, such as new climate policies or international agreements. This real-time capability ensures that investors are not only engaging in a sustainable investment but are also able to capitalize on time-sensitive opportunities in the evolving carbon market.

Supporting a Sustainable Future Through Investment

The platform allows investors to align their portfolios with global sustainability goals by directly contributing to carbon reduction projects through their investments. By offering access to a live market of carbon credits, Stankevicius International GO empowers retail investors to play an active role in the movement toward a lower-carbon world.

Key Benefits of Carbon Credit Trading for Retail Investors

- Portfolio Diversification: Carbon credits provide a unique asset class for investors looking to diversify and hedge against traditional market volatility.

- Eco-Conscious Investing: Investors can contribute to environmentally beneficial projects while seeking returns on their investments, combining profit with a positive environmental impact.

- Enhanced Market Access: Real-time trading puts retail investors on equal footing with institutional buyers, leveling the playing field and democratizing access to the carbon market.

The Future of Carbon Credit Trading for Retail Investors

With Stankevicius International GO’s user-friendly trading platform, the carbon market is no longer an exclusive domain for large corporations. Instead, it becomes an opportunity for all investors to take meaningful steps toward a sustainable financial future. As interest in green investing grows, the platform’s seamless, real-time trading options position Stankevicius International GO as a leader in democratizing access to sustainable investment solutions, paving the way for a more inclusive and eco-conscious market.

With this platform, individual investors can now be part of a collective effort to mitigate climate change, one trade at a time.